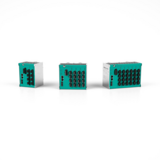

The need to modernize automation in the mining industry has lent momentum to the power conversion market in Europe and Russia. Market growth is bolstered by the fierce competition among mining companies, rising energy costs, and increasing awareness on the benefits of electric drives and motors.

New analysis from Frost & Sullivan "Power Conversion Market in the European and Russian Mining Industries" finds that the market earned revenues of $221.3 million in 2012 and estimates this to reach $272.6 million in 2017. The research covers electric motors and electric drives. Electric motors have a greater market share because they are a key component of electric drives and find use in a wide range of applications. Electric drives also hold tremendous promise due to their high-tech, energy-efficient functions.

“Power conversion products help optimize plant performance, improve functionality, lower production costs, and boost profit margins,” said Frost & Sullivan Industrial Automation & Process Control Research Analyst Maryna Osipova. “As such, alternative current (AC) electric drives and motors are gaining popularity in European and Russian mining companies as a means to decrease energy consumption and improve productivity.”

Demand for advanced AC power conversion products is also growing with the rising prices – 30 percent since 2010 – of electricity in Russia and Europe. This has fuelled the uptake of electric drives that are perceived to be one of the top energy-saving applications, capable of cutting down energy consumption by 25-50 percent.

However, limited financial resources due to escalating capital and operating costs is prompting mining companies in Russia and Europe to postpone or even cancel new automation projects. Consequently, the sale volumes of electric drives and motors have been moderate. High capital construction costs and a shortage of skilled personnel also discourage companies from initiating the modernization of their industrial automation equipment.

Further, the nationalization of the mining industry in Russia has resulted in higher tax obligations for market participants, affecting their revenues and delaying the implementation of scheduled as well as future automation projects.

“To address these challenges, power conversion product vendors should build strong relationships with end users to understand their requirements and create customized solutions,” observed Osipova. “Providing discount systems for loyal clients and offering flexible purchase options will aid market development.”